Take Control of Your Credit and Financial Future

Learn How to Apply Our 4-Step Framework for Securing Business Funding or Building and Repairing Your Credit.

This program is your step-by-step guide to taking control of your credit and rebuilding a solid financial foundation.

Get all the details about working with us in WealthPlan™ CreditMax PRO.

Learn to Earn

WealthPlan™ CreditMax PRO.

We offer a step-by-step credit improvement program designed to help you build, repair, and maximize your credit profile. Our proven strategies are easy to follow and focus on long-term financial growth. You’ll receive high-touch support through coaching sessions, personalized credit analysis, and one-on-one guidance to ensure you stay on track. Plus, you'll be part of an exclusive community of clients and credit experts—all working together to help you reach your financial goals faster.

Proven Credit Solutions

Follow the same trusted methods, tools, and services used in Ryan’s personal credit optimization and wealth-building journey.

One-on-One Coaching Sessions

Personalized sessions to review your credit strategy, address obstacles, and strengthen your mindset around credit and financial growth.

Private Member Community

Connect with others on the same journey—ask questions, share insights, and learn from the real-life experiences of fellow members working to improve their credit.

Flexible Learning Experience

Improve your credit on your schedule with flexible lessons and tools designed to fit your lifestyle—no pressure, no overwhelm.

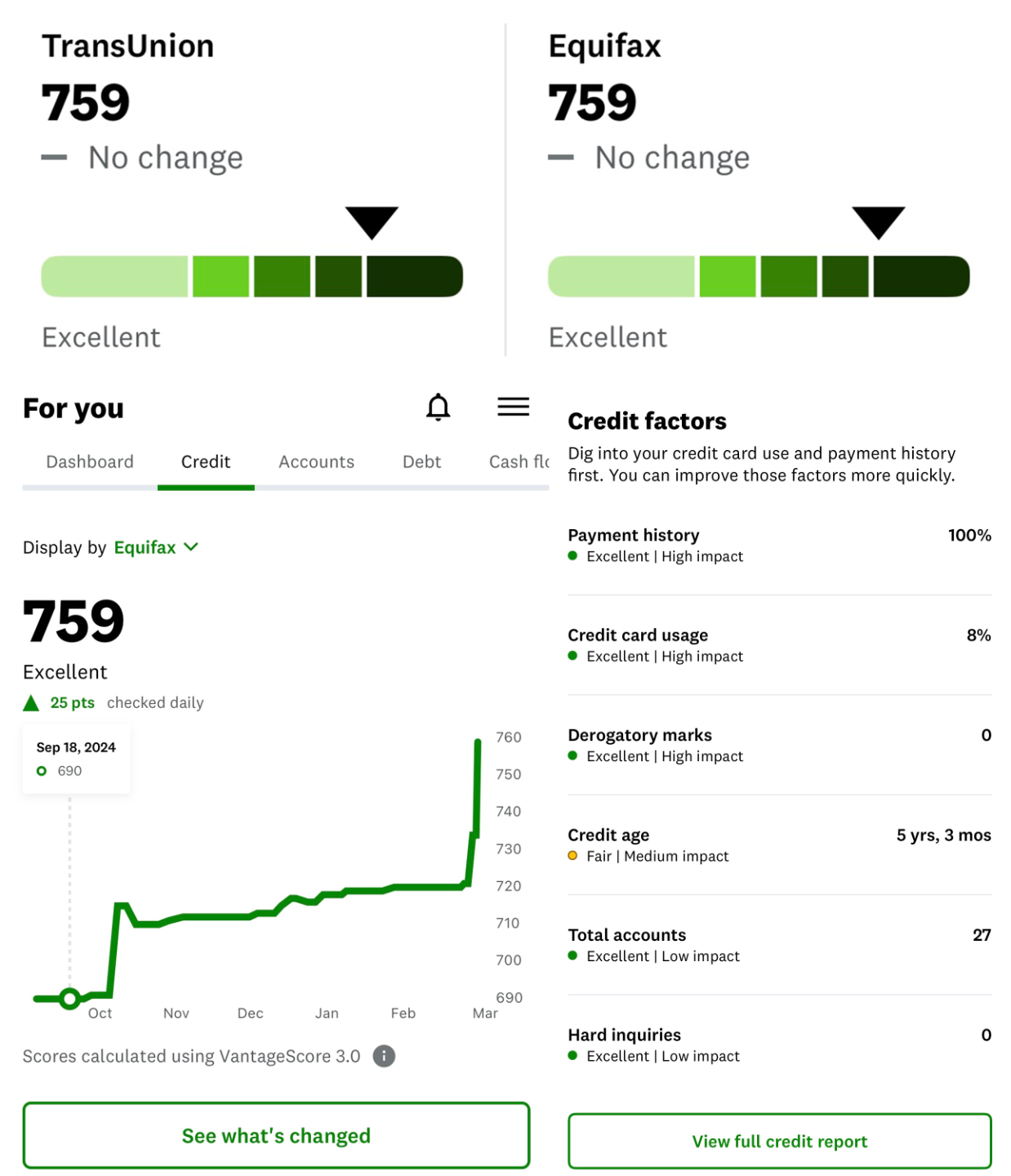

Member Results

Score jump for our member from 650 to 716 in less than one month + instant approval for new $5,000 credit card:

Hard inquiry removal for a member in 24 hours:

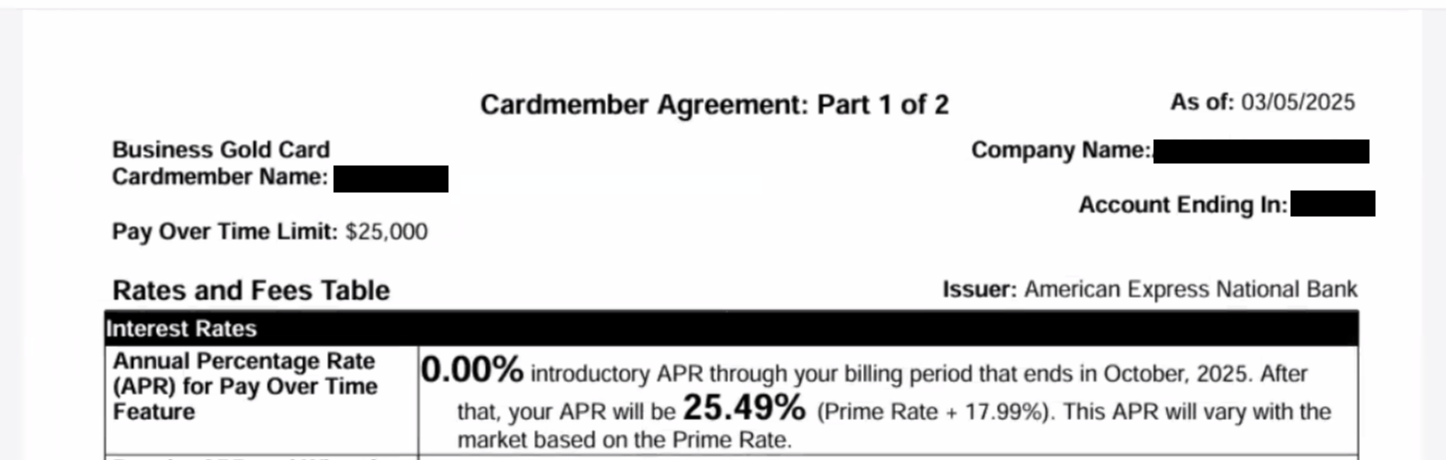

$15k in new credit instant approval at 0% interest:

$40k Amex Business Gold instant approval at 0% interest:

Our approach is consistent, strategic, and system-driven—designed to help you build strong credit step-by-step.

Here’s what we’ll work on together inside the CreditMax program:

-

Build Your Credit With Confidence: Learn how to strategically grow your credit score using real-world methods we’ve used to help clients increase their scores by over 100+ points—without overwhelming paperwork or confusion.

-

Create a Credit Roadmap: Develop a personalized plan to reach your credit goals—whether that’s qualifying for a home, accessing better interest rates, or making financial freedom a reality.

-

Protect and Strengthen Your Profile: Understand how to safeguard your credit during financial setbacks. We’ll show you how to build a resilient credit profile with diversified accounts and low-risk strategies.

-

Avoid Common Pitfalls: Break free from the top credit mistakes that keep people stuck—like high utilization, late payments, or unnecessary inquiries. With guided credit reviews, we’ll help you spot and fix issues before they cost you.

-

Build With Intention: Use our 7-step Credit Conviction Checklist to add accounts and manage credit wisely—so every move you make is part of a bigger, smarter plan.

-

Master the Credit Mindset: Shift how you think about credit—from fear and frustration to confidence and clarity. With the right mindset, you’ll stop reacting to your score and start using it as a tool for long-term financial growth.

Tools & Training

From Credit Clarity to Capital Power — Let’s Build:

Phase One: Review & Identify

Know Where You Stand

Before you can build, you must assess. In this foundational phase, we dive deep into your credit reports from all three major bureaus—Experian, Equifax, and TransUnion. We identify every account, score factor, and any inaccurate or harmful items that need to be addressed. You’ll get crystal-clear on your current credit profile, what’s helping you, and what’s holding you back. This is the diagnostic stage—where awareness becomes power.

Phase Two: Adjust & Correct

Clean, Organize, and Optimize

This is where the real transformation begins. We take targeted action on every negative or outdated item identified in Phase One—disputes, debt validation, goodwill letters, or direct creditor negotiations. At the same time, we build new habits: automated payments, utilization tracking, account organization, and daily practices that reduce risk and increase score potential. This is the longest—but most essential—part of the program.

Phase Three: Maximize & Expand

Build Your Financial Infrastructure

Once your profile is optimized, we begin to scale. This includes adding high-quality primary accounts, requesting strategic credit limit increases, and applying for business credit—even without a formal LLC. You’ll also learn how to properly use credit to earn points, travel rewards, and cashback—effectively getting paid to spend. Here, credit becomes a tool—not a burden—and your score becomes a gateway to greater opportunities.

Phase Three: Maintain

Protect the Asset

Now that your credit is in elite shape, we shift into long-term maintenance mode. This phase is about mastering your financial habits—keeping utilization low, payments on time, and tracking your accounts like an owner. You’ll continue earning points and rewards, maintaining strong relationships with lenders, and using your credit profile to support your bigger wealth-building goals. This is where your new lifestyle takes root—and your credit works quietly in the background, always in your favor.

Gain Instant Access:

The Investment

Hear It From Our Mentees

Alexis G:

"I’m in my mid-20s and didn’t have bad credit — but I also didn’t have a real plan. I knew I wanted to set myself up the right way from the start, not wait until something went wrong. I reached out looking for a coach who could guide me through building credit the smart way — and that’s exactly what I got. From choosing the right credit cards to learning how to use credit to my advantage, the support has been incredible. Now I have a 740 score, zero debt, and a strategy for growing my financial future. Starting early was the best decision I’ve made."

Erica D:

"My credit was stuck in the low 500s, and I had no idea how much it was affecting my life. I couldn’t get approved for a decent credit card, let alone think about buying a home. I was skeptical at first, but after the first session, I knew I made the right choice. They helped me create a plan, cleaned up my report, and taught me how to keep my credit healthy long-term. I’m now in the 700s and recently got approved for my first rewards credit card!"

Christopher J:

"I had excellent personal credit, but I didn’t know how to use it to get business funding — especially since I hadn’t set up an LLC yet. I wasn’t looking for credit repair, I was looking for strategy. That’s exactly what I found here. The team showed me how to structure my personal profile to qualify for business credit even without having an LLC, navigated me through the approval process, and access funding under my own name. I’ve secured over $35K in business credit so far, and I’m building momentum. Having someone who understands the game made all the difference."

Marcus R:

"I used to feel overwhelmed just thinking about my credit. Missed payments, high balances, and not understanding how the system worked had me stuck for years. I knew my credit was holding me back, but I didn’t know where to start or who to trust.

Working with this team changed everything. They broke it all down step-by-step — how to dispute errors, manage my accounts, and build a real plan. In just a few months, I’ve seen my credit score jump over 100 points and, more importantly, I finally feel in control of my financial future. This isn’t just credit repair, it’s real empowerment. Thank you!"

Isaiah M:

"I was embarrassed by my credit score. I avoided talking about it, even with family. But once I joined the program, I realized I wasn’t alone — and more importantly, I wasn’t stuck. They helped me understand the 'why' behind my score and how to take control. My score jumped over 90 points, and now I’m coaching my little brother on credit too."

Melissa F:

"I thought I had decent credit — until I tried to lease a new car and got hit with a high-interest rate. That’s when I realized I needed to take credit more seriously. They helped me understand my credit profile and identify what was holding me back. Within a few months, I refinanced my car at a much better rate and saved thousands. Best financial decision I’ve made in years."

$25k Amex Business Gold instant approval at 0% interest:

Proven methods and maintenance strategies:

Credit limit increases for a member:

About

Ryan Leslie

- Harvard educated

- Experienced investor

- Full-time entrepreneur

- Seasoned options trader

- Founder of WealthPlan™

A senior at Harvard by the age of 19, Ryan has been featured on the cover of Black Enterprise and interviewed by Forbes, Yahoo Finance, Nasdaq, and The Wall Street Journal.

Known for his accomplishments in music and media, the Grammy nominated recording artist and multi-platinum music producer founded WealthPlan™ to educate and inspire investors worldwide.

His panel discussions and live interviews on finance have garnered millions of views. He teaches his mentees proven financial strategies that allow them to live life independently and abundantly.

Gain Instant Access:

The Investment

Frequently Asked Questions

What is a credit improvement program?

How does the program work?

Is this a credit repair service?

How long does it take to see results?

Will you remove negative items from my credit report?

What do I need to get started?

Nothing on this website should be considered legal, financial, or credit advice. The information provided is for general educational and informational purposes only and does not constitute a guarantee, promise, or warranty of any specific credit outcome. Past results do not guarantee future results. Examples of credit score improvements or financial outcomes are illustrative only and should not be interpreted as typical or guaranteed results.

Credit repair involves disputing inaccurate, outdated, or unverifiable information on your credit reports. While we work to assist you in this process, we do not and cannot guarantee that your credit scores will improve or that negative items will be removed. Results may vary based on your individual credit profile, actions taken by the credit bureaus, and your ongoing financial behavior.

We are not a law firm, and our services are not a substitute for legal advice. You should consult an attorney or a licensed financial advisor for guidance on your specific situation.

EARNINGS & RESULTS DISCLAIMER:

Any financial progress, credit score improvements, or related testimonials mentioned on our website are examples of what may be possible. They are not guarantees of what you will experience. You agree that WealthPlan CreditMax (or your company name) is not responsible for your financial success or failure, credit decisions, or results, and makes no representations or warranties regarding the outcome of using our services or programs.

YOUR SUCCESS DEPENDS ENTIRELY ON YOUR OWN EFFORT, DISCIPLINE, COMMITMENT, AND FOLLOW-THROUGH. WE CANNOT PREDICT AND DO NOT GUARANTEE THAT YOU WILL ACHIEVE A SPECIFIC CREDIT SCORE OR FINANCIAL RESULT. YOU ACKNOWLEDGE AND AGREE THAT INDIVIDUAL RESULTS VARY AND THAT THERE ARE NO GUARANTEES OF SPECIFIC OUTCOMES FROM USING THE INFORMATION OR SERVICES PROVIDED ON THIS WEBSITE OR BY OUR TEAM.